- ONLY current authorized Club Accounting Form (CAF)

signers can submit and sign club check requests

- Failure to submit all the required information

and supporting documentation will result in the check

request being delayed and/or denied

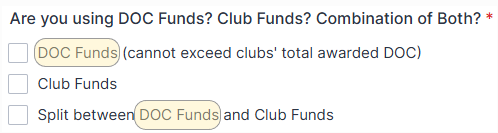

We highly encourage you to use your DOC funds (when

eligible) before using your club funds! If

insufficient DOC funds are available, then club funds can be used

to cover the remaining amount. Please have an authorized

signer

email us or visit our office (with photo I.D.) for a

report of your club and DOC balances to help your club make

the most of your funds!

Introduction

Club Check Requests are used for club reimbursement and direct

vendor payments. Clubs that are eligible for reimbursement

must be an active and registered club with Student

Organizations & Leadership (SO&L) and have a

valid Club Accounting Form for the academic year.

Receiving Checks

All COMPLETED check requests submitted by 5 PM on Wednesdays,

with required information and supporting documentation, will be

processed and mailed by the following week on Thursday.

Club Accounting Form

The 2025-2026 Club Accounting Form (CAF) is available

now!

We encourage you to complete the CAF as soon as your club

registration is approved by SO&L.

Direct link to CAF:

here

Note: per the contract, 2025-2026 CAFs are valid

through 9/30/2026

- A new CAF must be submitted by the club and validated by ASI

Accounting Services every academic year.

- Clubs that do not have a CAF or made changes to

President/Treasurers need to submit a new form to remain eligible

for reimbursement.

- Click the link and log into Adobe Acrobat Sign with your Sac

State account, select “ASI – Club Accounting

Form,” then fill out the form.

- The form link will be emailed to each email address listed on

the CAF to complete their part, and the workflow must be fully

completed before we can approve it.

- Once the form is signed by all approved signers (including

Faculty Advisor, SO&L and lastly ASI), the club signers will

receive a copy of the CAF.

- Please visit Student Organizations & Leadership’s Treasurer

Resources website for detailed information, including a video on

how to complete the CAF (SO&L:

Treasurer Resources).

DOC Fund Guidelines

Purpose

The purpose of ASI Dollars for Organizations and Clubs (DOC)

funding is to support Sac State students in their endeavors to

increase the quality of campus life and learning. ASI DOC funding

reimburses organizations and clubs for money spent on events,

food, promotion, conferences and much more.

We highly encourage you to use your DOC funds (when eligible)

before using your club funds! If insufficient DOC funds are

available, then club funds can be used to cover the remaining

amount.

Please have an authorized signer

email us or visit our office (with photo I.D.) for a report

of your club and DOC balances to help your club make the most of

your funds!

Operating Rule (recently updated!)

Find how you can use DOC funds by reading the

guidelines here: DOC Funding Guidelines

Steps for Reimbursement

Clubs and Organizations who would like to

receive DOC funds must complete the following steps

every academic year:

1. Complete the Student Organizations and Leadership (SO&L)

club registration process.

2. Submit a Club

Accounting Form (CAF) for ASI.

3. If the club or organization meets all DOC funding

requirements, ASI Accounting Services will transfer $800 to

your account after we approve your CAF.

4. Use the funds to get reimbursed for supplies, events, or

activities, and have fun! The supplies, events, and

activities MUST be eligible (refer to Operating Rule) for DOC

use. Save your receipts!

5. Submit a check request for reimbursement via Jotform and

select DOC Funds.

$800 Grant & Maximum Cumulative Allocation of $2,000

The DOC Funding Guidelines establish a maximum cumulative

allocation of $2,000 per club account within an academic year,

with additional funding contingent upon the expenditure of at

least $800 in previously awarded DOC monies.

This structure ensures responsible use of student funds, prevents

excessive accumulation of unspent allocations, and promotes

equitable access to financial resources across all

recognized clubs and organizations. By capping allocations and

reinforcing spending requirements, ASI maintains fiscal

accountability while supporting a broad range of student-led

events and activities.

After the CAF’s final approval, ASI Accounting

Services will review your club’s DOC account:

- If your DOC balance is $1,200 and less, the $800 grant will

be transferred.

- If your DOC balance is $1,200.01 and more, we will not

transfer the $800 grant until you use enough of your funds and

reach $1,200 and less.

Note: Our team reviews your DOC balance again at the end of every

month for eligibility. Awarded funds are on a first-come,

first-serve basis. DOC will not be awarded after June 1st.

If you believe your club is eligible, but do not see the DOC

transferred, please reach out to our team for assistance.

Examples of Common Uses for DOC Funds

Marketing expenses (e.g., banners, posters, flyers, sign holders,

stickers, etc.)

Equipment purchases (e.g., canopies, tables, etc.)

Graduation Regalia (including gowns, stoles, and

caps purchased through ASI’s

Student Shop in the Union)

Promotional shirts, jackets, and hats for the club/org.

(Note: cannot be resold)

Room Rental Invoices from University Union/The WELL/Games Room

Registration fees to conferences, conventions, and competitions.

Travel Expenses (e.g. mileage for personal vehicles, gas for car

rentals, hotel, bus/train/air fare)

Meals and Refreshments for Club/Org meetings or banquets that are

on-campus and open to all students

Team Building events with ASI’s Peak Adventures

(e.g. The

Challenge Center)

Insurance for events

Please check back as we add more!

Hospitality Policies

Per the CSU Chancellor’s Office, the Hospitality Policy applies

to all student organizations and requires additional information

to be filled out on the Club Check Request form whenever the type

of hospitality involves:

- Entertainment Services – these are contracted services that

fall under equipment/venue rentals, decor, music (DJs), and

performers.

- Food and Beverage – reasonable provision of a meal (catered

or restaurant) or light refreshments (beverages, hors d’oeuvres,

pastries, cookies).

- Awards and Prizes – something of value given or bestowed upon

an individual, group, or entity in recognition of service to the

university or achievement benefiting the university or with the

expectation of benefit accruing to the university or for other

occasions that serve a bona fide business purpose.

- Promotional Items – items that display the name, logo or

other icon identifying the university such as a keychain, coffee

mug, calendar, or clothing.

Check Request Requirements

- Completely fill out the Check Request Form on

Jotform: https://form.jotform.com/241087037358156

- Enter full name, address, phone number, and email address of

payee (person/company/vendor being paid)

- Enter total amount of payment owed

- Enter club/organization name and account to be charged

- Choose the type of Expense (Supplies, Travel, or Outside

Services)

- Fill out the Hospitality section completely

- Fill out the remainder of the check request form

including entering a detailed description of the purpose of

payment

- Upload required documentation (see Supporting Docs)

- Only Authorized signers on approved CAF can

authorize and submit requests.

For example, a club’s president, treasurer, or like-officer

listed on the ASI Club Accounting Form (CAF)

Supporting Docs

Every check request submitted by an authorized club

signer will include attaching required supporting

documents. Select the type that closely relates to your

request for a list of the documentation.

Because of varying situations, the list below may not capture all

requirements. In these cases, we will email the club for

additional support.

You can also refer to “The

Holy Check Request Grail – Cheat Sheet” for a list of the

required documentation.

Proof of Payment

If someone is seeking a reimbursement using your club funds, the

payor needs to provide proof of payment to the authorized

CAF signer, who will then attach the proof to the check

request.

ONLY required when reimbursing someone and not paying the vendor

directly.

Debit or Credit Card

If receipts show the last four digits of the Debit or Credit

Card (CC) used, attach an image of that CC showing only

the last four digits and cardholder’s full

name. The last four digits on the card should match

the number on the receipt.

For a good example of an itemized invoice, receipt, and

debit/credit card to attach to the check request,

please see: Debit or Credit Card Example

Debit or Credit Card (CC) via Contactless Payment (e.g.

Apple Pay)

If receipts show the last four digits of the Debit or Credit Card

(CC) used, attach an image of that CC showing only the last four

digits and cardholder’s full name AND a screenshot of the Apple

Pay screen that shows the physical card number and the Apple Pay

number (listed on the receipt).

For a good example of an itemized invoice, receipt, debit/credit

card, and Apple Pay screen to attach to the check request,

please see: Contactless Payment Example

Card or Bank Statement

If receipts do NOT show the last four digits of the Debit or

Credit Card (CC) used or a debit/credit card image cannot be

provided, attach a card or bank statement showing only the

transaction charges and the cardholder’s full name.

For a good example of an itemized invoice, receipt, and

credit/bank statement to attach to the check request,

please see: Bank Statement Example

General Equipment & Supplies

- Jotform Check Request

- Itemized invoice/receipt (shows all items purchased, plus

subtotal, S/H, taxes, fees)

- Proof of payment (credit card, bank statement)

- If items were shipped, proof of delivery (photo of the

item, packing slip, delivery confirmation, etc.) or note in

the check request description that item(s) was received

Food and/or Beverages

- Jotform Check Request

- Itemized invoice/receipt (shows all items purchased, plus

subtotal, S/H, taxes, fees)

- Proof of payment (credit card, bank statement; not

required if paying directly to company)

- If number of attendees is less than 25, attach a list of

attendees who benefitted from the food and their business

relationship to campus (e.g. student, faculty, staff, etc.)

- Tips are only reimbursed up to 15% of the receipt’s

subtotal UNLESS tip is included (required) in the bill by

the vendor (Cash tips are not reimbursable, debit/credit

card transactions only)

- If tip was written on receipt, attach card or bank statement

to show the total amount paid including tip

- Note: Alcohol is an unallowable expense and will not

be reimbursed

Membership Dues

- JotForm Check Request

- Itemized invoice/receipt

- List of paying members’ names

- Proof of payment (credit card, bank statement; not

required if paying directly to company)

Conference/Convention/Meeting Registration

- Jotform Check Request

- Itemized invoice/receipt

- List of paying members’ names (if more than one person)

- Proof of payment (credit card, bank statement)

Awards

- Jotform Check Request

- Application from winner

- Proof that award was announced to the club or public (meeting

minutes, email, social media post)

- Process of how the award winner was chosen

- W-9 (W-9)

Scholarships

- Jotform Check Request

- Application from winner

- Proof that the scholarship was announced to the club or

public (meeting minutes, email, social media post)

- Process of how the scholarship winner was chosen

- Student ID (only if winner is CSUS & Los Rios CC student)

- For non-CSUS student recipients, the scholarship check will

be cut to the financial aid office of the school to then be given

to the student

Donations

- Jotform Check Request

- Memo explaining donation (include date, organization name,

org’s address, amount of donation, signature of an authorized

signer)

- Information on organization receiving donation (screenshot of

website is OK)

- Example of a Donation Memo and information on organization

Direct Vendor Payments

- Jotform Check Request

- Itemized invoice to pay

- W-9

CSUS, University Union, The WELL, Aramark Invoices

- Jotform Check Request

- Itemized invoice to pay

Mileage Reimbursement (personal car)

- Jotform Check Request

- Printout of total route traveled (Google Maps) using CSUS as

starting destination

- Proof of event attendance (name badge, conference schedule

handed out at conference, picture at the event, etc.)

- Will reimburse up to $0.725 per mile for

travel 1/1/2026 and after ($.70 per mile for travel before

1/1/26)

- Note: Club officers can impose a limit on the reimbursement

amount to the vendor by specifying the limit in the description

of the check request. Additionally, if the amount that could be

reimbursed exceeds the limit imposed by the club, ensure the

“Amount to be Paid” section on the check request form matches the

limit.

Gas Reimbursement (car rental)

- Jotform Check Request

- Car rental agreement

- Itemized gas receipts

- Proof of payment (credit card, bank statement)

- Proof of event attendance (name badge, conference schedule

handed out at conference, picture at the event, etc.)

Hotel

- Jotform Check Request

- Itemized invoice/receipt

- Proof of payment (credit card, bank statement)

- Proof of travel (e.g. original boarding pass) OR

- Proof of event attendance (name badge, conference schedule

handed out at conference, picture at the event, etc.)

Bus/Train/Air Travel

- Jotform Check Request

- Itemized invoice/receipt

- Proof of payment (credit card, bank statement)

- Proof of travel (e.g. original boarding pass) OR

- Proof of event attendance (name badge, conference schedule

handed out at conference, picture at the event, etc.)

- University Travel Waiver if paying in advance for 15+

students

Contracted Services, Honoraria, Speaker/Performer Fees

- Jotform Check Request

- Memorandum of Agreement Form (MOA)

- W-9 (W-9)

Transfers

- Jotform Check Request

- Invoice (Catering Order from UEI, for example)

- Memo from club describing what amount needs to be transferred

and why

Advance Checks

Advance Check requests are reviewed on a case-by-case basis AND

requires prior approval. All inquiries must be made

in-person at our office or via email at

asiaccounting@csus.edu.

Please note: implications for not submitting original receipt and

proof of travel within two weeks following the event include the

loss of your club/organization’s privilege for advancement of

funds for a period of no more than two semesters. Further

action, up to and including suspension, of your club account may

be necessary.

FAQ

What qualifies as an advance check?

Advances are only for when out-of-pocket funds are not

available. Examples include: paying for outside

services (e.g. DJs), travel, and events in advance.

How many advances can I submit?

Only one open, pending advance check request can be allowed per

club.

We allow only one open pending advance for a club at any given

time. If your club has an upcoming travel expense for

multiple club members, we recommend one person to purchase

all the flights in advance, submit a check request to

include the flight receipt to show all flights purchased.

After the travel event has passed, the payor is responsible

for submitting the proof of travel for all traveling persons

to asiaccounting@csus.edu to

remove the pending status.

FAQ

See our frequently asked questions (FAQ) below.

If you still have questions after reviewing our website, please

contact us at asiaccounting@csus.edu.

How do I pay for my club/organization membership dues or

make deposits into my account?

You can pay your club/organization membership dues at the

ASI Student Shop window! They are located on the 3rd floor

of the University Union by the North Elevator.

Bring a completed “Club Deposit” sheet and your Sac State

OneCard!

- The ASI Student Shop can provide your club account number,

but you will need to fill out the Club Deposit sheet.

- Printed copies of the Club Deposit

sheet are located in the wall file organizer

outside of the shop (between ASI’s Accounting Services door

and North Elevator) or you can print the

Club Deposit sheet (PDF), then fill it out.

- Your Sac State OneCard is required for paying club/org. dues

and making deposits.

Please review the Club Deposits

page for full details and how to minimize your time at

the window.

Note: their hours differ from Accounting Services’ hours.

See ASI Student Shop hours and their other services at asi.csus.edu/asi-student-shop.

When paying club/organization membership dues or making a

deposit, can I pay with a credit card?

No, the ASI Student Shop cannot accept debit card, credit

card, or ApplePay for club/org. payments. Only cash and

checks are accepted.

Do I need to provide my OneCard for all deposits?

Yes! ASI Student Shop requires your Sac State OneCard,

so they can email you the receipt and provide a printed copy

after your deposit. Please keep your receipts.

Can you tell me how much I owe towards my club?

The ASI Student Shop and ASI Accounting Services does not have

this information. You will need to ask your club officers

or club advisor for that information.

I made a deposit 1-7 days ago and it is not showing on my club

report- where are the funds?

Deposits go through our POS system and takes one week for

funds to be transferred into our accounting database.

Request a Senior Accounting Tech or Student Shop Supervisor

to run a report from the POS to show recent deposits made.

How can I request for my club account balance?

Please email us at asiaccounting@csus.edu

or visit us in-person at our office with a photo I.D. Only

authorized signers on the current CAF and the staff/faculty

advisor can request to see your club balance.

What are unallowable expenses?

You cannot use your Club or DOC funds on: personal items,

alcohol, tobacco products, recreational drugs, and weapons

(firearms, etc.)

There are additional restrictions on using DOC funds.

Please refer to the

DOC Fund Guideline.

What is a proper description on a check request?

Descriptions should include what, why, who, when, and

where.

For example: Weekly Club Meeting on October 6th, 2025 in

Foothill Suite of the University Union.

Why do I need to provide an itemized receipt?

Our team needs to verify that there aren’t any inappropriate

expenses, such as personal items, alcohol, recreational drugs,

and weapons. We also verify that all applicable taxes are

applied to the items.

Why does ASI require original receipts? What kinds of

receipts are acceptable?

We require original receipts to prevent fraud. The types of

receipts that are acceptable are original, fully itemized

receipts and/or original invoices. All items purchased

must be listed on the receipt.

ASI Financial Policy states that non-business/personal items and

alcohol are not reimbursable.

I lost my receipt, what can I submit?

Please submit a card or bank statement (showing the full

name of the cardholder and the transaction) and a completed

Purchase Memorandum.

The Purchase Memo must be completed

by an approving signer explaining the loss of

receipts, all attempts were made to recover receipt, and

future intentions to ensure that members keep receipts.

If the missing receipt was for food, please include on the

Purchase Memo what food/drink was purchased as well as

a statement confirming that alcohol was not purchased.

Can I pay with cash and still get reimbursed?

Yes. In the instances of making purchases with cash,

the person is reimbursed by providing appropriate signatures,

supporting receipts, and/or documentation showing proof of cash

payment. When paying with cash, “cash” is

usually listed on the receipt, which we can accept.

If I already provided a copy of my card, do I need to

provide another copy for a different check request?

YES, all check requests are stored in a secured vault, therefore,

we do not make copies of cards previously submitted. You

must submit an image of your card with each new check

request.

What happens to my bank statement/credit card copy after they are

submitted?

All check requests are filed in a secured vault that is limited

in access.

Why do I need to submit a copy of my debit/credit card, bank

statement, or cashed check as proof of payment?

Fraud is an all too common problem and one that ASI takes

seriously. In order to protect the individual, department

and club, ASI requires proof of payment on any items paid with

check or credit card to prove that the person who made the

payment is the person who is reimbursed.

If the receipt or invoice shows the last digits of the card

number, then only images of the credit/debit card, with

the first 12 numbers blocked out for security purposes, as

well as the full name of the cardholder is required.

If the receipt/invoice does not have a card number on it, then a

copy of the individual’s debit/credit card or bank statement is

required showing the withdrawal.

If the statement does not have the individual’s name, but has the

account number, then we also need an image of the card with

the person’s name to go with the statement.

For payments made with a check, attach a copy of the cashed check

from your bank statement online.

For an example of the debit/credit card image or bank

statement to attach to the Jotform check request, please refer

to The Holy

Check Request Grail – Cheat Sheet.

What if I am paying an individual for a service? What

kind of documentation is needed?

Along with the appropriate Jotform check request, if you are

paying an individual or unincorporated company for providing a

service, it is considered income to that

individual/company. The documentation needed is an

Memorandum of Agreement (MOA) and a W-9.

Examples of services include DJ services, coaching or referee

fees, rentals, performances (such as music and dance),

speaker fees, etc.

Why do I need a W-9 for the individual/company?

We report any personal income made through the performance of

services to the Internal Revenue

Services, and therefore, need their W-9 for that

information.

I’m an authorized signer for my club- why can’t I sign for

myself?

Per GAAP Internal Controls, conflict of interest policies, and

proper business practices, the signee and payee cannot be the

same individual as it can constitute as fraud as there is no

other individual confirming the payment to the payee.

How can my club accept donations from outside organizations?

Please refer to Student Organizations & Leadership’s

Treasurer Resources on how to accept donations, which can be

deposited into your club account. Please note this process

can take up to eight weeks until you see the funds in

your account.

What do I need to know to host a fundraising event?

DOC funding cannot be used towards fundraising events hosted by a

club as it does not comply with

DOC Funding Guidelines.

If you are interested in requesting a cash box for your

fundraising event, please refer to the ASI Student Shop for this service.

Please refer to Student Organizations &

Leadership’s website

and handbook for fundraising policies and procedures.

Our club needs a tax ID, EIN or W-9, how can we get one?

Clubs and organizations are not separate business

entities, therefore, do not have an individual tax

ID or Employer Identification Number (EIN).

Clubs are not allowed to use ASI or Sacramento State

University’s tax IDs.

Clubs that need a tax ID or W-9 can go to Student

Organizations & Leadership (SO&L) to request a

formal letter explaining this.